- Home

- Properties

- Property

- Default Layout

- Property layout v1

- Property Layout v2

- Property Layout v3

- Default Layout

- Property Layout v4

- Property layout v1

- Property Layout v5

- Property Layout v2

- Property Layout v6

- Property Layout v3

- Property Layout Full Width

- Property Layout v4

- Property Landing Page

- Property Layout v5

- Property layout Tabs v1

- Property Layout v6

- Property Layout Tabs v2

- Property Layout Full Width

- Property Landing Page

- Property layout Tabs v1

- Property Layout Tabs v2

- Realtor

- Others

loydgrondin012

About loydgrondin012

Understanding Physical Gold IRA Fidelity: A Comprehensive Report

In recent years, the interest in gold as an investment has surged, particularly among those looking to diversify their retirement portfolios. A Physical Gold IRA, or Individual Retirement Account, allows investors to hold physical gold and other precious metals as part of their retirement savings. Fidelity, a leading investment firm, offers various retirement solutions, including options for investing in gold. This report will explore the concept of a Physical Gold IRA, the offerings by Fidelity, the benefits and drawbacks of investing in gold, and considerations for investors.

What is a Physical Gold IRA?

A Physical Gold IRA is a specialized type of self-directed IRA that permits individuals to hold physical precious metals like gold, silver, platinum, and palladium in their retirement accounts. Unlike traditional IRAs that typically hold stocks, bonds, or mutual funds, a Physical Gold IRA provides a tangible asset that can serve as a hedge against inflation and economic uncertainty.

Fidelity’s Offerings for Gold IRAs

Fidelity does not directly offer a Physical Gold IRA, but it does provide options for investing in gold through various products and services. If you adored this article and also you would like to obtain more info about iragoldinvestments.org generously visit our web-page. Investors can consider the following avenues:

- Gold ETFs: Fidelity offers several exchange-traded funds (ETFs) that track the price of gold. These funds hold physical gold bullion and can be bought and sold like stocks. They provide a way to gain exposure to gold without the complexities of managing physical assets.

- Mutual Funds: Fidelity also provides mutual funds that invest in gold mining companies and other related sectors. This option allows investors to benefit from the growth of the gold industry rather than directly holding gold itself.

- Brokerage Services: Investors can use Fidelity’s brokerage services to purchase gold coins or bullion from reputable dealers. However, these purchases would not be within an IRA unless they are structured correctly.

Benefits of Investing in Physical Gold

Investing in a Physical Gold IRA comes with several advantages:

- Inflation Hedge: Gold has historically maintained its value over time, making it an effective hedge against inflation. In times of economic downturn, gold often retains its purchasing power better than paper assets.

- Portfolio Diversification: Adding gold to a retirement portfolio can enhance diversification. Gold tends to have a low correlation with stocks and bonds, which can help reduce overall portfolio risk.

- Tangible Asset: Unlike stocks or bonds, physical gold is a tangible asset that investors can hold. This can provide a sense of security, especially during times of financial instability.

- Tax Advantages: A Physical Gold IRA enjoys the same tax benefits as traditional IRAs. Contributions may be tax-deductible, and earnings can grow tax-deferred until withdrawal.

Drawbacks of Investing in Physical Gold

Despite its benefits, there are also drawbacks to consider:

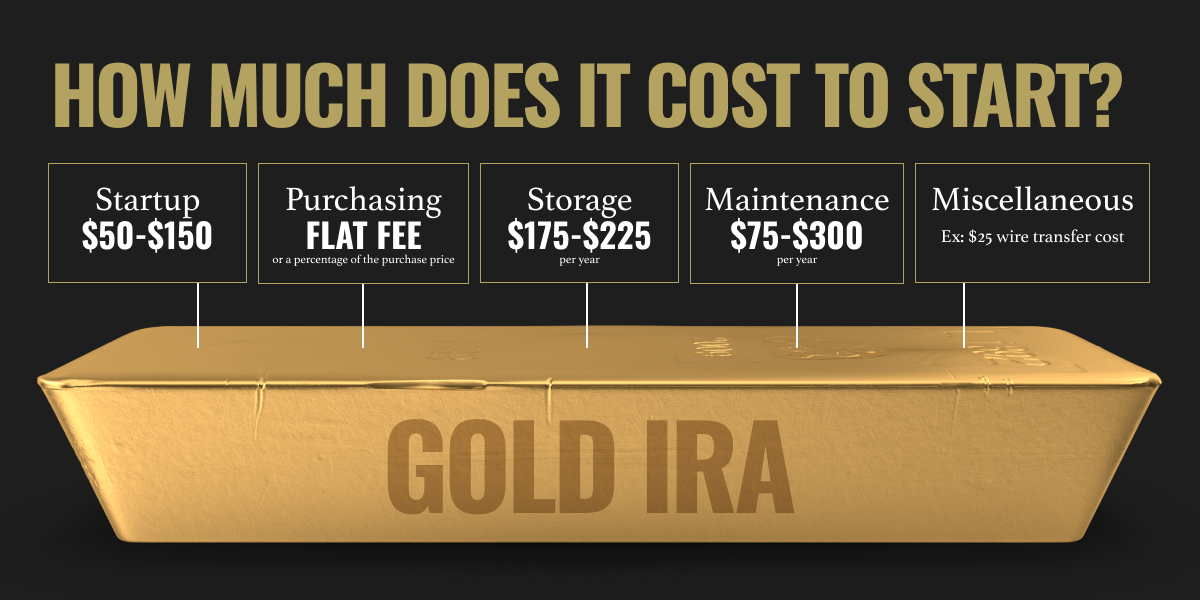

- Storage and Insurance Costs: Physical gold must be stored in a secure facility, which often incurs storage fees. Additionally, investors may need to purchase insurance to protect against theft or loss.

- Liquidity Issues: Selling physical gold can be less straightforward than selling stocks or bonds. Investors may face challenges in finding buyers or may have to accept lower prices during market downturns.

- Market Volatility: While gold can be a safe haven, its price can be volatile in the short term. Investors may experience significant price fluctuations, which can impact their retirement savings.

- Contribution Limits: Like other IRAs, there are annual contribution limits for Physical Gold IRAs. This may restrict the amount of gold an investor can acquire within their retirement account.

Considerations for Investors

Before investing in a Physical Gold IRA through Fidelity or any other institution, investors should consider several factors:

- Research and Education: Understanding the gold market and the specific products offered by Fidelity is crucial. Investors should educate themselves about gold prices, market trends, and the mechanics of gold IRAs.

- Choosing the Right Custodian: Since Fidelity does not offer direct Physical Gold IRAs, investors need to choose a reputable custodian that specializes in precious metals. The custodian will manage the gold and ensure compliance with IRS regulations.

- Understanding Fees: Investors should be aware of all associated fees, including storage, insurance, and transaction costs. These fees can impact overall returns and should be factored into investment decisions.

- Long-Term Strategy: Gold should be viewed as a long-term investment. Investors should have a clear strategy for how gold fits into their overall retirement plan and be prepared to hold their investment through market fluctuations.

- Consulting Financial Advisors: It may be beneficial to consult with financial advisors who have experience with gold investments. They can provide personalized advice based on individual financial situations and retirement goals.

Conclusion

A Physical Gold IRA can be a valuable addition to a retirement portfolio, offering diversification and protection against economic uncertainty. While Fidelity does not offer direct Physical Gold IRAs, it provides various investment options that allow investors to gain exposure to gold. As with any investment, it is essential to weigh the benefits and drawbacks carefully, conduct thorough research, and consider long-term strategies. By understanding the intricacies of investing in gold, individuals can make informed decisions that align with their retirement goals and financial objectives.

Sort by:

No listing found.