- Home

- Properties

- Property

- Default Layout

- Property layout v1

- Property Layout v2

- Property Layout v3

- Default Layout

- Property Layout v4

- Property layout v1

- Property Layout v5

- Property Layout v2

- Property Layout v6

- Property Layout v3

- Property Layout Full Width

- Property Layout v4

- Property Landing Page

- Property Layout v5

- Property layout Tabs v1

- Property Layout v6

- Property Layout Tabs v2

- Property Layout Full Width

- Property Landing Page

- Property layout Tabs v1

- Property Layout Tabs v2

- Realtor

- Others

bethanylaffert

About bethanylaffert

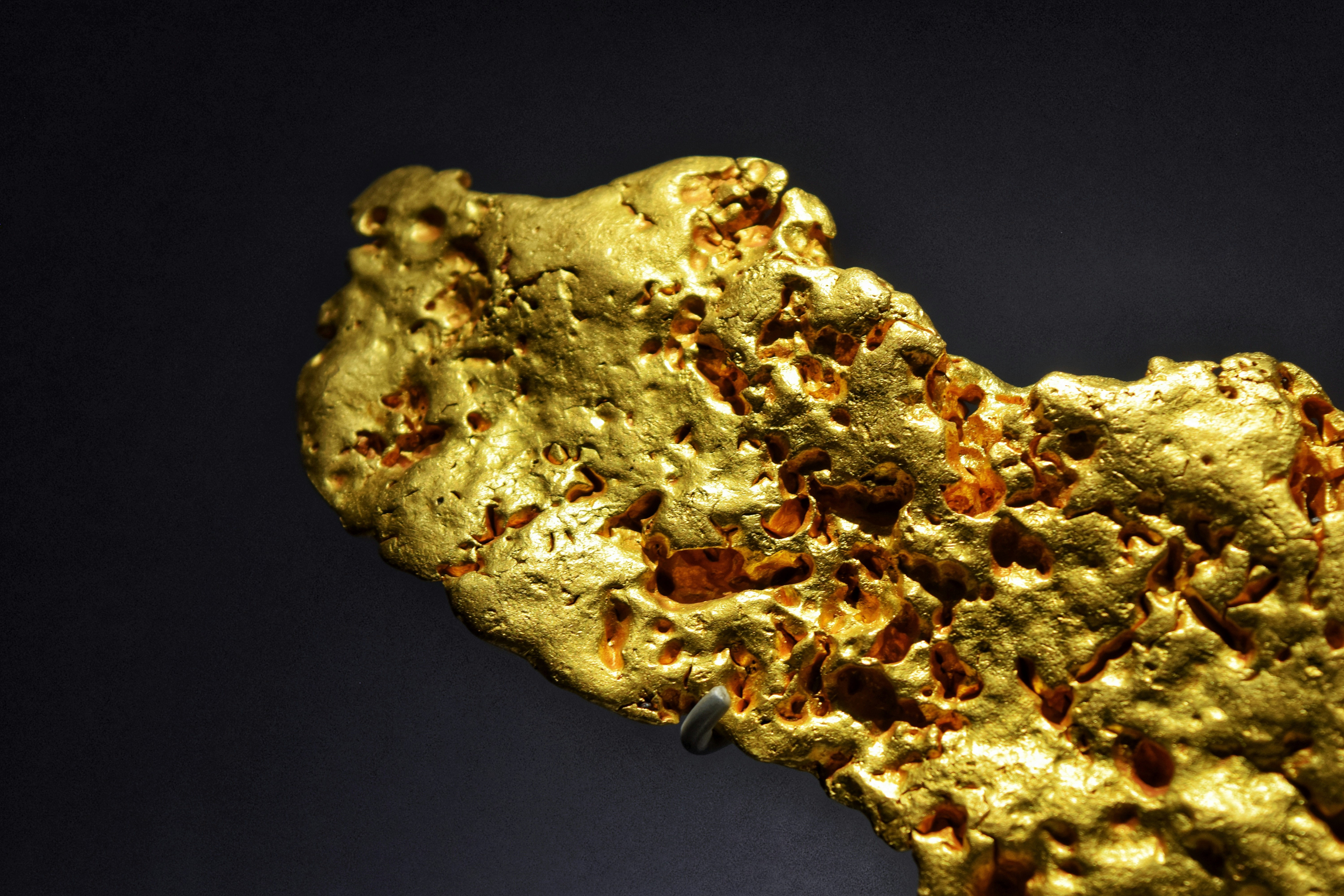

Gold IRA Reviews: A Complete Information to Investing In Precious Metals

As financial uncertainty looms and inflation charges continue to fluctuate, many traders are turning to different property to safeguard their wealth. Among these alternatives, gold has lengthy been considered a safe haven, resulting in the growing reputation of Gold Particular person Retirement Accounts (IRAs). This article delves into the world of Gold IRAs, inspecting opinions, benefits, and potential pitfalls to help investors make informed choices about their retirement financial savings.

Understanding Gold IRAs

A Gold IRA is a type of self-directed Individual Retirement Account that permits traders to carry bodily gold and other precious metals as part of their retirement portfolio. Unlike conventional IRAs that primarily spend money on stocks, bonds, and mutual funds, Gold IRAs present a chance to diversify with tangible belongings. This may be notably appealing throughout occasions of economic instability, as gold has a historical past of retaining worth.

The Appeal of Gold

Gold has been an emblem of wealth and a store of value for centuries. Its intrinsic worth, combined with its limited supply, makes it a gorgeous investment. When in comparison with fiat currencies, which might be printed in limitless portions, gold maintains its purchasing energy over time. This characteristic is why many monetary consultants advocate together with gold in a diversified investment strategy.

The Gold IRA Process

Investing in a Gold IRA entails several steps. First, investors must select a custodian, a financial institution that manages the account and ensures compliance with IRS laws. Next, investors can fund their accounts by means of contributions or rollovers from existing retirement accounts. Once the account is funded, buyers can purchase eligible gold merchandise, equivalent to bullion coins and bars, that meet IRS standards.

Opinions of Gold IRA Companies

With the rising curiosity in Gold IRAs, numerous companies have emerged to assist traders in organising and managing their accounts. Listed below are a few of the top-reviewed Gold IRA companies based on customer suggestions and business analysis:

- Birch Gold Group: Birch Gold Group has garnered optimistic reviews for its customer support and instructional assets. The corporate supplies a wealth of knowledge to help investors perceive the benefits of gold investments. Customers appreciate the personalised strategy and the transparency in fees.

- Augusta Precious Metals: Identified for its exceptional customer support, Augusta Precious Metals has acquired excessive marks for its straightforward process and academic supplies. The corporate gives a singular ”one-on-one” approach, guaranteeing that shoppers are properly-informed about their funding decisions.

- Goldco: Goldco is commonly praised for its person-friendly website and intensive educational resources. The corporate specializes in helping clients roll over their existing IRAs into Gold IRAs and has acquired constructive suggestions for its educated employees and efficient service.

- Noble Gold: Noble Gold stands out for its commitment to customer satisfaction and transparency. The company offers a range of funding choices and has received favorable reviews for its competitive pricing and low charges.

- American Hartford Gold: This company has constructed a robust status for its commitment to customer service and instructional sources. American Hartford Gold provides a variety of gold and silver products, and many shoppers respect the corporate’s transparent price construction.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA affords several benefits:

- Diversification: Gold can present a hedge against market volatility, allowing buyers to diversify their portfolios and scale back general threat.

- Inflation Protection: Gold has historically maintained its worth throughout inflationary periods, making it a reliable retailer of wealth.

- Tax Advantages: Gold IRAs offer the same tax benefits as conventional IRAs, allowing buyers to defer taxes on features till they withdraw funds during retirement.

- Tangible Asset: Unlike stocks and bonds, gold is a physical asset that investors can hold. This tangibility can present peace of mind during financial downturns.

Potential Pitfalls

Whereas Gold IRAs supply quite a few advantages, buyers should also be aware of potential pitfalls:

- Fees: Organising and maintaining a Gold IRA can contain numerous charges, together with setup charges, storage charges, and transaction charges. It’s essential for traders to understand the price construction of their chosen custodian.

- Market Risks: Though gold is often seen as a secure funding, its price can nonetheless fluctuate based on market situations. Traders must be prepared for the possibility of short-term volatility.

- Limited Funding Options: Gold IRAs are restricted to particular sorts of gold products that meet IRS standards. This limitation could not enchantment to all investors.

Conclusion

Because the financial landscape continues to evolve, gold ira companies gold IRAs current a viable possibility for these seeking to diversify their retirement portfolios. With a wealth of information obtainable via numerous firms, investors could make informed decisions based on their financial objectives and threat tolerance. By fastidiously reviewing Gold IRA companies and understanding the advantages and potential pitfalls, individuals can take proactive steps to safe their monetary future.

In summary, Gold IRAs provide a singular alternative for traders to include precious metals of their retirement savings. With the fitting research and guidance, individuals can navigate the world of Gold IRAs and potentially improve their monetary security in the years to return.

Sort by:

No listing found.